Here to help!

If you have any questions or queries, you can call our team on 01902 939 000 we would be more than happy to help.

Home » PPI REBATE

Have you ever had a successful PPI pay-out from your bank or other financial institution? If you have, then the chances are that you could now be due a tax rebate!

Most people paid too much tax on their PPI refund. This was automatically deducted, even though most people did not need to pay it.

In April 2016 changes to personal tax allowance were introduced which allows taxpayers to earn up to £1,000 a year tax-free on their savings and this also includes the statutory interest paid on any PPI refunds they may have had. As PPI is taxed as a lump sum payment at the point it is paid, most people who have paid tax on PPI refunds since April 2016 are entitled to some money back.

PLEASE NOTE: We are no longer accepting any new claims; However we are continuing to work hard to resolve any existing claims for our customers.

*Please see our full T&Cs here for explanation of our fees and cancellation policy.

You may be able to reclaim tax paid on a PPI refund going back up to 5 years. Whether you can claim depends on your personal circumstances.

One of the main reasons why it is essential to get your claim in as quickly as possible is due to the amount of time needed to make a claim. It’s important because of the tax years involved.

Where your tax claim is successful, we will be entitled to a fee of 40% plus VAT plus an administration charge of £15.00 plus VAT.

When you received a PPI refund you would have received interest on your payment. Your bank will have deducted tax from the interest element of the payment and you received the balance as redress. However, if the total interest you’ve earned from your savings and the PPI statutory interest is less than your personal savings allowance, you can claim all PPI tax paid during the last 5 tax years.

FIND OUT IF YOU’RE OWED UP TO £40,000!** START YOUR FREE PLEVIN PPI CHECK TODAY

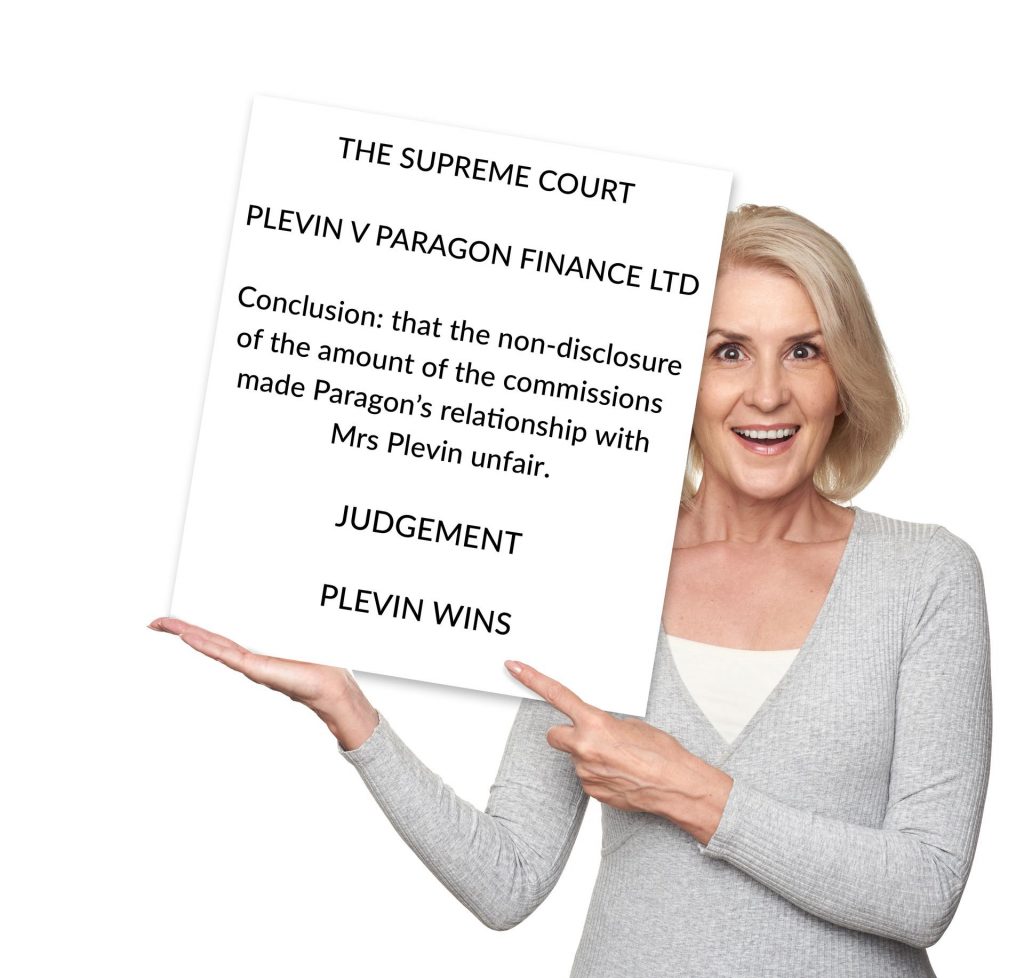

If you have ever taken out Payment Protection Insurance (PPI) on a loan or credit card then you may be able to make a Plevin PPI claim if your lender failed to disclose the commission they were paid for selling you the PPI policy.

This is due to a Supreme Court ruling (Plevin v Paragon Personal Finance Ltd) where the lender failed to disclose to the customer the high amount of commission they were paid for selling the PPI policy. The Court ruled that the lender should refund the customer. Your Claim Matters offer a FREE Plevin PPI checking service* where we can check if you were one of the millions of people who were affected. Click Here to start your FREE check now. Find out now! You could be owed thousands of £££’s and not realise it. Let Your Claim Matters check for you for FREE* today. CLICK HERE to start now!If you have any questions or queries, you can call our team on 01902 939 000 we would be more than happy to help.

Tax rebate services are not regulated by the Financial Conduct Authority.

ADDRESS DETAILS

Your Claim Matters

84 Salop Street

Wolverhampton WV3 0SR

NAVIGATION